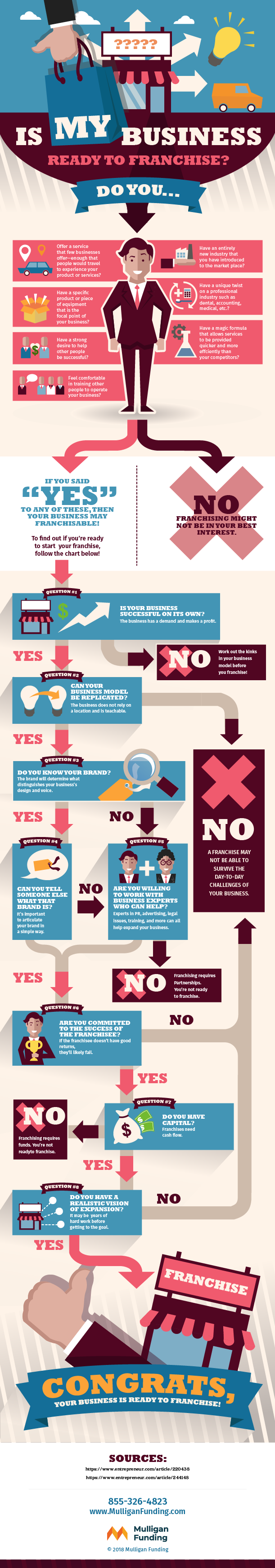

For companies that have achieved a successful business model, franchising is the logical next step toward expanding and growing. Opening an additional location is a great way to expand your business. However, not all businesses are ready… it takes time and effort to get to the point where franchising makes sense.

Decide if your business is ready to take the next step. Ask yourself the following:

Can You Outsource?

If you’re a hairdresser or a graphic artist whose customers want you and only you specifically, then franchising may not be an option. You can’t be in two places at once. Consider training your employees to provide the exact same services that you do, and get your clientele used to working with a team. Once you’ve done this, then franchising your business might work for you.

Can You Play by the Rules?

As a franchiser, there are dozens of state and federal regulations that you must abide by. Getting up to speed with everything could potentially be time-consuming and costly. Take the time to research franchising laws and regulations in your state. Once you’re confident that you’re compliant, you’re ready to consider franchising.

What Does Market Research Say?

Does your concept only have merit in a certain region of the country? If you own a snow removal business in Virginia, franchising into other states may not make much sense due to variations in the climate; but there’s always a market for restaurants no matter where your business is located. If your service is popular and in demand, then you may want to consider franchising.

Are You Consistent?

Consistency is key when you are opening a franchise. Franchise customers expect quality and the overall experience to be the same at every location. Do McDonald’s french fries taste different depending on where you buy them? No, and McDonald’s goes to great lengths to make sure of it. If you can replicate your product exactly, then you’re ready to franchise.

Do You Have the Capital for Business Franchise?

Franchising takes capital. Even though your franchisees shoulder the brunt of the cost of each new location, it costs money to go through the legal process and create a business plan. An alternative lending provider such as Mulligan Funding has the solution for you in the form of flexible, high-approval working capital loans for franchising. Got capital? Then you’re ready to franchise.

These are just a few guidelines for deciding whether franchising is the right step for you. This infographic gives you the resources you need to decide for yourself if the time is right.

The information shared is intended to be used for informational purposes only and you should independently research and verify.

Note: Prior to January 23, 2020, Mulligan Funding operated solely as a direct lender, originating all of its own loans and Merchant Cash Advance contracts. From that date onwards, the majority of funding offered by Mulligan Funding will be by Loans originated by FinWise Bank, a Utah-chartered Bank, pursuant to a Loan Program conducted jointly by Mulligan Funding and FinWise Bank.