By Andrew Sobel

How many of your clients think of you as being essential to their growth and profits? How many of them, in contrast, view you as a cost to be carefully managed? The difference is huge. When clients see you as contributing to their growth and profits, they can’t get enough of you. But when they view you as a cost—a commodity—they’ll try to minimize your fees and they’ll cut you whenever it’s convenient.

This distinction cuts to the heart of the challenge of developing enduring, trusted client partnerships—of building your clients for life. Perhaps never before have there been so many pressures impacting the ability of companies to acquire and retain clients.

Let’s look at these forces, and then review a set of proven strategies for combating them and consistently growing your client revenue every year.

Six Trends Impacting Your Client Relationships

There are no less than six major trends that are making it tougher than ever to build mutually beneficial client relationships:

1.Demands for more value. Clients want more value in their relationships. They are being asked to do more for less by their own customers and shareholders, and that pressure is being passed on to you

2.Sophistication and transparency. Client executives are more sophisticated than ever. They usually know more about their own business than you do—and in many cases they also know a lot about your business. Information about you and your competitors is typically widely avail- able.

3.Procurement. To get more value for money, many companies are using procurement processes to buy higher-end services. You’re now in the same boat as the person who’s selling copier paper or sheet metal.

4.Limited executive access. Executives are time- starved. They could fill their day three times over with people who want to see them. So just getting access—having the face time so you can build a relationship—is very difficult.

5.Competitive expansion. Everyone has targeted the same attractive market segments, dramatically increasing competition. Firms that once faced only two or three major competitors now find they face half a dozen or more—some of which have come from entirely unexpected directions.

6.Consolidation. Corporate clients are dramatically consolidating their use of external service providers and advisors. One large bank went from using 700 different training firms to 70. Another company reduced the number of consulting firms it used from 20 to four. In short, if you want to be a strategic provider you have to significantly sharpen your skills at relationship management.

Yet, notwithstanding these powerful trends, client relationships are more important than ever to your success. Client executives still gravitate towards external suppliers and service providers they know and trust. They stick with partners who have proven their ability to deliver. Despite the growing role of procurement and the use of competitive bidding, relationships play an absolutely crucial role in winning and keeping clients.

Client Relationships Re-Imagined

Because of the trends cited above, the old models of client development are insufficient. This is why we call our approach “Client Relationships Re-Imagined”: It’s not sufficient to simply fine tune the existing model of client development— you need to re-imagine it. A “relationship” today means much, much more than having feel-good personal rapport with an executive. It is something you earn through continually adding value and building a deep reservoir of trust based on quality delivery and personal integrity.

| Traditional Strategies | Re-Imagined Strategies |

| Win the transaction | Win a long term relationship |

| Build a relationship and then add value | Add value in order to earn a relationship |

| Cultivate a key buyer | Cultivate multiple stakeholder relationships |

| Understand the client’s problem | Re frame to define the total problem |

| Try to “move up” in the organization | Become a person of interest to top executives |

| Push — get your solutions in front of buyers to convince them | Pull — get your thought leadership in front of buyers to draw them in |

| Sell what you know | Sell what your firm knows |

Based on twenty years of proprietary research into the ingredients of enduring client relationships, we’ve identified the strategies and skills that make organizations and individuals extraordinarily effective at every stage of the client development process. The good news is that many of the required changes involve learnable mindsets, skills, and best practices that can be rapidly adopted.

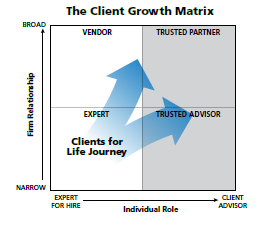

There are two key dimensions that enable clients for life. First, there’s the role of the individual professional. Are you an expert for hire—a tradable commodity? Or are you an indispensable client advisor who has a seat at the table?

The second dimension is your firm’s relationship with the client. Is it narrow and based on one service and one executive relationship? Or is it broad, and based on the provision of several or more services and on many executive relationships? When the latter occurs, you have transcended any single individual’s role and institutionalized your client relationship.

If you put these two dimensions together, you get the Client Growth Matrix, illustrated below. This framework illustrates the journey from a commodity expert to a trusted advisor or trusted partner role with the client.

Developing Your Clients for Life

During the sales process—even before you enter the matrix—how you behave sets the stage for how the client will perceive you later on. If you have what we call the “expert mindset,” you focus on the sales transaction, emphasize methodology, accept the client’s narrow definition of the problem, and spend much of your time “telling.” When you have the advisor mindset, in contrast, you focus on building the relationship, adding value in the conversation, asking powerful questions, and uncovering a truly urgent client problem or opportunity—which together create an eager buyer.

In short, how you handle yourself during the sale will powerfully impact your ability to move out of the Expert quadrant once you begin the engagement.

For the first project or transaction, you’re seen as an expert—you haven’t yet built up enough trust to be considered part of the client’s inner circle. The challenge is to move out of that box fairly quickly. Otherwise, you’ll remain a commodity. No matter what field you’re in, there are always other “experts” (or alternative products and services) that a client can hire to do the job. In this lower-left quadrant you’ll be potentially subjected to price competition and competitive bids, and you’ll never have a seat at the table with your client where you can learn—before your competition—about their upcoming plans and priorities.

It is essential to bring deep expertise to the table—it’s your ticket to entry. But over time, you need to evolve your role so you can have a bigger impact and enjoy deeper client loyalty.

Some firms move into the upper left “Vendor” quadrant, and this can be a very fruitful position to be in. Here, you’re doing lots of work for the client, but you don’t have any strong, trusted-advisor relationships. If the expert is like a plumber or electrician, the vendor is like a general contractor who employs many different tradesmen. The point is this: As long as you are to the left of the centerline of the matrix, you’re in “RFP territory” where procurement always seeks multiple, competitive bids. You may find yourself constantly having to justify your continuing role as a supplier.

When you evolve into the lower-right Trusted Advisor quadrant, the client sees you as trusted resource who knows their business better than anyone else and is helping enable important business goals. If you work with a company that has a fairly broad range of solutions, you may then also move into the upper-right Trusted Partner quadrant. When you’re a Trusted Partner, you have built many-to-many relationships and become a strategic provider.

In either case, when you’re on the right side of the matrix the result is more sole-source business, greater loyalty, and the opportunity to make a bigger impact on the client.

From Expert for Hire to Client Advisor

In order to move to the right along the X axis of the matrix, you need to surround your deep expertise with additional skills. Based on studying over 10,000 highly successful professionals in many different markets, and personally interviewing over 1000 C-Suite executives about their most trusted advisors, we’ve identified a set of specific skills that will help you leverage your expertise and become a trusted client advisor.

The first step is a mindset change. Most professionals are subject matter experts—as they must be. But that deep, narrow expertise can become a major barrier to building great client relationships. Experts often become myopic and cannot see the forest for the trees. They focus on their own solutions and expertise at the expense of building a deep understanding of the client’s issues. They often burrow so deeply into their own specialty that they are unable to see the broader context of the client’s business.

The table, below, illustrates the skills of the expert versus the broader capabilities of the advisor.

| The Expert | The Advisor |

| Tells | Asks great questions and listens |

| Is for hire | Has “selfless independence” |

| Is a narrow specialist | Is a deep generalist |

| Analyzes | Synthesizes |

| Builds professional credibility | Builds deep personal trust |

| Is reactive | Is a proactive agenda setter |

| Sells | Creates a buyer |

Remember, these are complementary, not entirely different, skill sets. The client advisor is also always a deep expert. The difference is that he or she has developed a set of additional skills. These skills help them build a trusted relationship, put their expertise in the context of the client’s highest-level agenda, bring broader business acumen to the table, and add more value.

From a Narrow to Broad Firm Relationship

Firms also need to move upwards along the Y axis in the Client Growth Matrix. The reason is very simple: The best rainmaker in the world cannot succeed without strong institutional support. And, they cannot single-handedly build a Trusted Partner relationship—they need help. There are a number of organizational enablers that are needed to build flagship client relationships. These enablers must be sponsored at the company level. For example:

- An account planning and development process. It requires careful planning and internal collaboration to grow a large client relationship. A robust account planning system is the lynchpin for doing this well. The secret is to focus on planning, not the plan.

- A client leadership developmental pipeline. Great trusted advisors don’t always spontaneously develop and then rise to the top. You need to have a multi-level program of professional development that helps your professionals not just build their technical skills but also their relationship-building capabilities.

- Multi-level client listening. The best firms get regular client feedback through a variety of channels. These include leader-to-leader visits to take stock of the overall relationship; formal relationship reviews by the account leader; surveys to get feedback from a broad group of client executives; and informal discussions about the client’s agenda.

- A supportive measurement and reward system. Compensation systems need to be fine-tuned to support both short-term performance objectives and long-term relationship development. Otherwise, there will be a disconnect between what management says they want (clients for life) and what they are actually encouraging people to do (maximize this sale, this quarter).

- A consistent, differentiated client experience. The experience that clients perceive is created through dozens of interactions, over time, with many different people from your company. It is also based on the effectiveness and lack of friction of the processes you create for client relationship management.

These and other organizational enablers are just as critical to client relationship success as the skills of your client-facing professionals.

Are Trusted Advisors Made or Born?

The short answer is: A little bit of both. It’s true that some people have natural attributes that enable them to be highly effective with clients right out of the gate. But these skills can also be learned. And, most importantly, everyone can improve. Not everyone will become a trusted advisor to their clients, but everyone can ask better questions and become a better listener, for example, therefore improving their relationships. Not everyone will be able to build CEO relationships, but just about everyone can deepen their relationship with the director or vice president they are working with. Even a narrow, subject-matter expert can dramatically improve their effectiveness with clients by enhancing their relational capabilities.

How it Works

In working with well over 200 leading firms around the world on this challenge, we’ve learned that there are five key factors that make a program to build clients for life a success:

1.Long-term leadership sponsorship.

While results can be seen in weeks or months, really changing your culture and organizational capabilities can take several years or more. Consistent leadership support—reinforced through regular messaging and personal role-modeling of client- centric behaviors—is essential.

2.Multiple, integrated learning interventions. Building “clients for life” capabilities requires a mindset change, new skills, new behaviors, and the adoption of best practices. We have found, therefore, that combining different learning interventions over time has a powerful impact that one-off training lacks. These include:

• In-person training workshops

• Mobile, digital learning

• Virtual live events

• Coaching, both one-on-one and in small groups

• Small accountability groups led by internal champions

• Codification and sharing of internal best practices

• Action learning projects

For example, our mobile learning program, Building Your Clients for Life, provides an entire curriculum of short lessons that participants store on their mobile devices and consume anywhere, anytime. This is usually integrated with live training as well as internally-led accountability groups that meet monthly and share best practices.

We find that many professionals benefit from bite-sized chunks of content that they can easily access and use. These could range, for example, from a 60-minute webcast on building c-suite relationships to a short video, accessed from their smartphone, on asking powerful questions.

3.Organizational enablement. At the institutional level, are you formally supporting and enabling a client-centric culture? A brief assessment can quickly highlight which organizational processes—e.g., key account management, client listening, internal collaboration, etc.— need to be improved in order to cultivate a more client-centric culture and empower front-line professionals.

4.A segmented, graduated approach. Different groups will have different skill needs. For example:

| Level | Emphasis |

| 1. Entry to Mid-Level | Core relationship-building skills |

| 2. Experienced | Trusted advisor skills and best practices |

| 3. Senior practitioners | C-suite skills, managing complex sales |

| 4. Key account leaders | Key account management growth |

By using the right strategies and building the right skills,it’s possible to achieve major improvements in the depth,breadth, and quality of your client relationships—and, ultimately, in revenue growth. Doing so requires consistent effort and the willingness to invest and learn, but the returns are well worth it.

A leading financial institution wanted to strengthen its corporate banking business and reinforce its position as the top bank partner for corporate treasurers and CFOs. Over 500 corporate bankers participated in a multi-faceted Trusted Advisor program that included a series of skill-building workshops, an eLearning curriculum with small accountability groups, client forums, and follow up coaching. A key success factor was leadership commitment through personal role-modeling, frequent communications, and message reinforcement. Client service ratings reached historic highs after the program, and the win ratio for deals increased.

There’s more where this came from! If you enjoyed this chapter, download our FREE ebook, Mulligan Funding’s Ultimate Guide to Business Relationships, to access 9 additional chapters jam packed with practical tips and guidelines to maximize your business relationships.

The information shared is intended to be used for informational purposes only and you should independently research and verify.

Note: Prior to January 23, 2020, Mulligan Funding operated solely as a direct lender, originating all of its own loans and Merchant Cash Advance contracts. From that date onwards, the majority of funding offered by Mulligan Funding will be by Loans originated by FinWise Bank, a Utah-chartered Bank, pursuant to a Loan Program conducted jointly by Mulligan Funding and FinWise Bank.