At some point, many business owners have had to (or will need to) consider alternative funding as a means of small business financing. Many end up using their personal assets to provide working capital for their business. Personal assets such as credit cards, savings, investments, home equity loans, etc. This can be tricky and may also limit how they’re able to grow their business. And, those not eligible for a bank loan are left frustrated looking for an alternative.

Maybe you’ve found yourself in this situation, unsure of where to get the funding you need for your business. In hopes of helping to clear the fog, we’ll share some advantages of alternative funding for your small business financing needs.

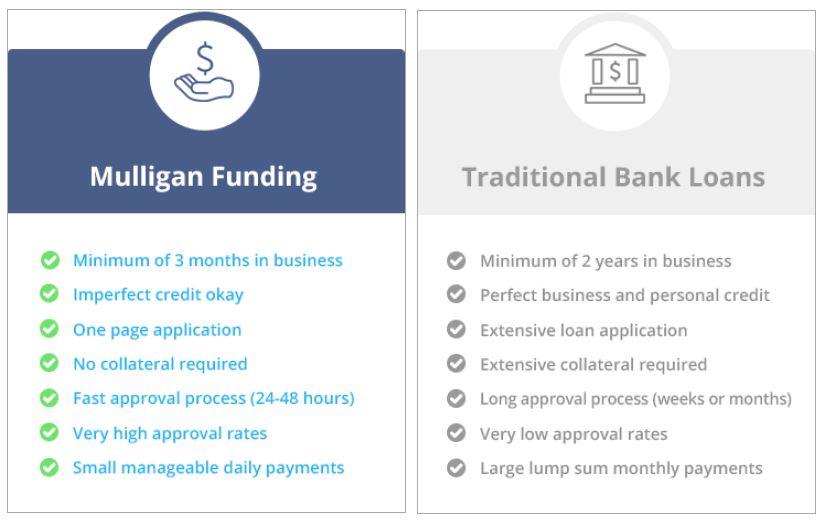

Let’s start by looking at the different requirements for traditional and alternative business funding options.

How can small business financing help me?

As you continue in your research for small business financing, it’s important to consider how this funding can help your business grow. Here are some ways that new business funding may be able to help your small or medium sized business.

- Purchasing inventory or equipment for your business.

- Funding for tools or staffing. Funding may allow you to bid on a big project, or for a new customer, ensuring that you can fulfill the expectation of the project.

- Help with cash-flow during slower periods. Additional funding may allow you to hold on to valuable employees. It can also help you avoid being put on C.O.D. with vendors, potentially damaging your business’ reputation.

- Allow for expansion with additional location costs, equipment, and staffing needs, enabling you to meet a greater market demand.

- Support your marketing needs, allowing you to reach additional customers and grow your business effectively.

- Providing additional capital for much needed repairs or renovations.

Small business financing requirements

Understanding the requirements for the different types of small business financing available should help guide you towards which option is right for you. Many of the businesses that we speak with come to us frustrated by the lengthy bank approval process, only to have their loan request rejected by the bank. To save you time and effort, make sure to take these requirements into consideration before starting the loan application.

Now that you have a little context on what you need to consider, hopefully you’ll feel more confident selecting the right type of small business financing for your company. Banks are great if you can fit their requirements, but many businesses don’t, and that’s where Mulligan Funding comes in.

Mulligan Funding and new business funding

We don’t want to simply give you money and send you on your way – we want to work with you on a plan for success. When you’re ready, give us a call at 855-326-3564 or email us at Support@MulliganFunding.com. Talk with our loan advisors to see how we might be able to help your small business.

The information shared is intended to be used for informational purposes only and you should independently research and verify.

Note: Prior to January 23, 2020, Mulligan Funding operated solely as a direct lender, originating all of its own loans and Merchant Cash Advance contracts. From that date onwards, the majority of funding offered by Mulligan Funding will be by Loans originated by FinWise Bank, a Utah-chartered Bank, pursuant to a Loan Program conducted jointly by Mulligan Funding and FinWise Bank.