Almost every business owner finds themselves in need of additional cash-flow at some point. And when they do, they’ve traditionally turned to banks as their funding source. Unfortunately, the banking process can create insurmountable obstacles to obtaining a business loan.

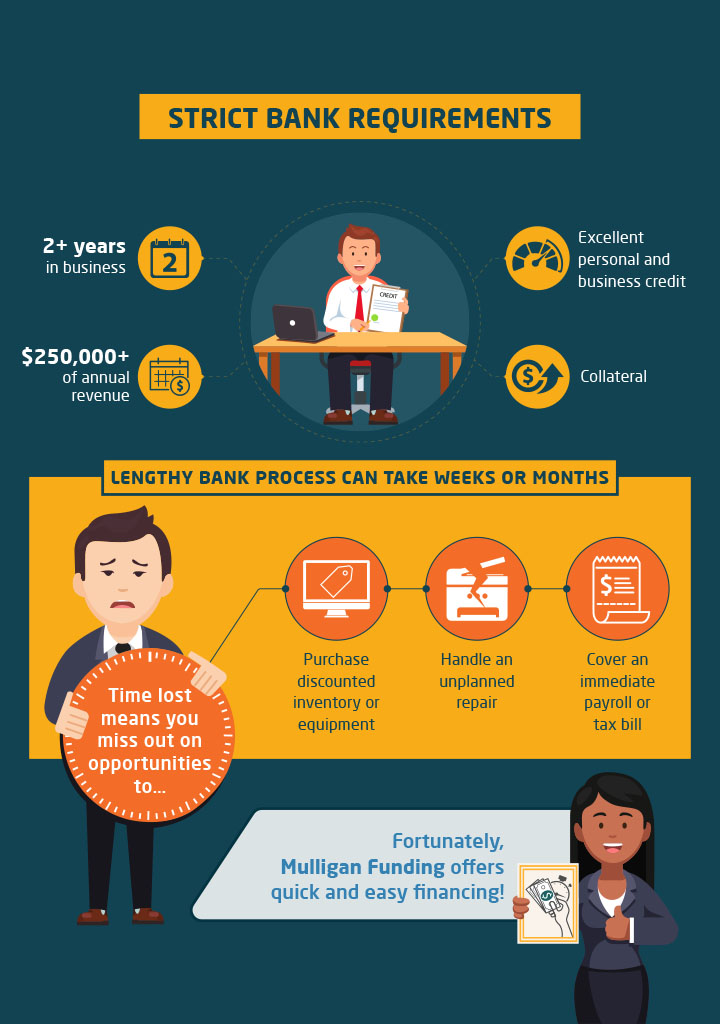

Have you ever tried to get a bank loan? They tend to have very strict requirements to qualify. How strict? According to recent research, big banks approve around 28% of all business loan applications.

Additionally, the loan process can take weeks or months to complete. If you have time-sensitive opportunities or obligations, this type of delay can severely damage your business.

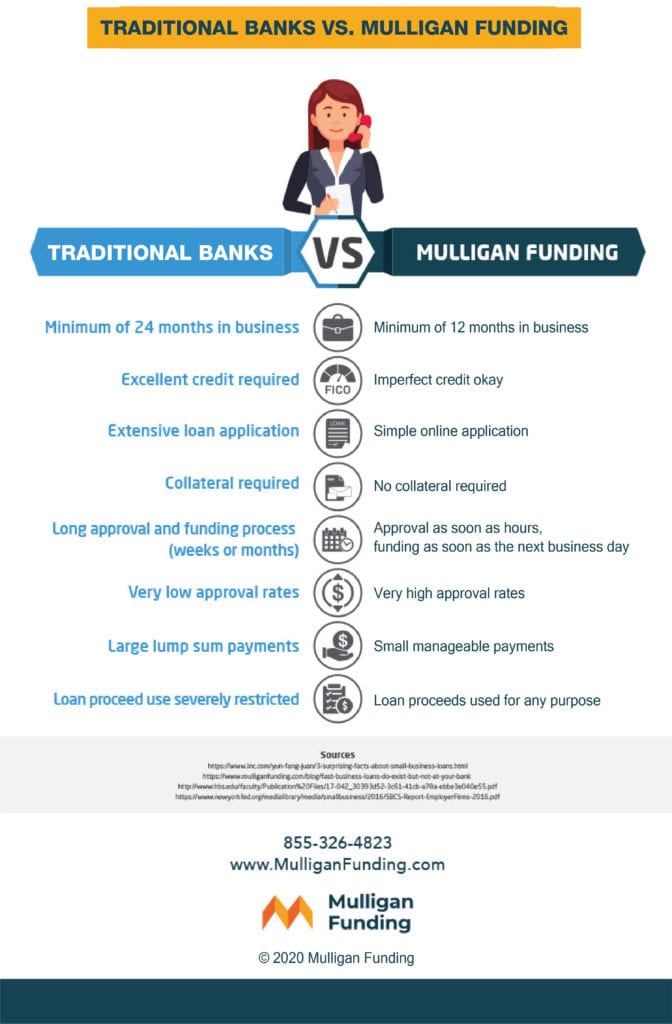

This chart shows a solid alternative to bank financing. The comparison is quite revealing.

Call Mulligan Funding at 855-326-3564 to discuss your financing options today!

The information shared is intended to be used for informational purposes only and you should independently research and verify.

Note: Prior to January 23, 2020, Mulligan Funding operated solely as a direct lender, originating all of its own loans and Merchant Cash Advance contracts. From that date onwards, the majority of funding offered by Mulligan Funding will be by Loans originated by FinWise Bank, a Utah-chartered Bank, pursuant to a Loan Program conducted jointly by Mulligan Funding and FinWise Bank.